|

Every tax is a pay cut. Every tax cut is a pay raise.

Citizens for Limited Taxation |

|

|

It's good to see the Board of Selectmem

only want to raise our taxes by two percent

, versus the 2.5 percent that is permitted by Proposition 2.5.

How about zero percent for next year?

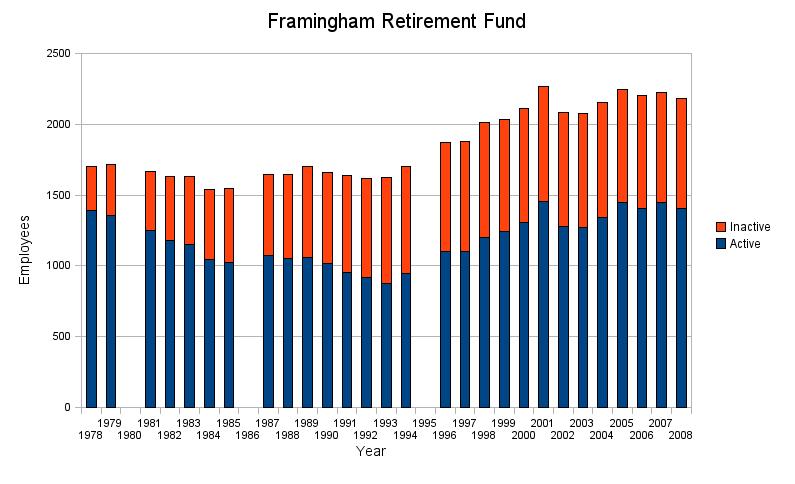

I say this because Framingham has hired too many employees. I've generated a graph of town/school employees in our retirement fund (generated from many annual reports).

This problem of having too many employees in the public sector is not a new one but it seems persistent throughout history.

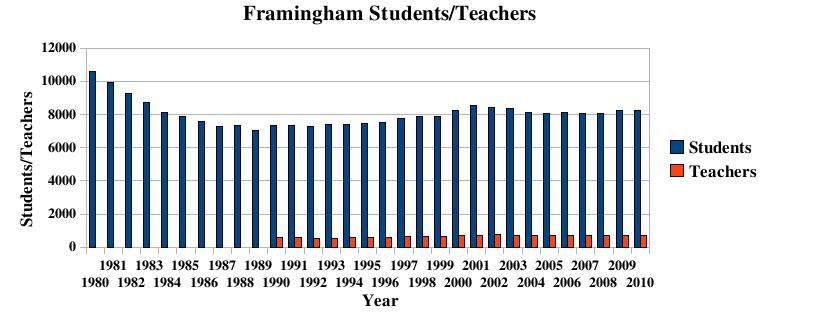

Some people will claim that the schools are growing with more students. These people are ignorant. I'd like to see evidence of that. Here's my graph of our student/teacher population.

Our Quinn bill issue and SMOC suit costs are negligible in comparison to this. What is also not stated is that Property tax contributions from the taxpayers has been monotonically increasing. This is very, very important and cannot be over emphasized. Allow me to repeat this in case you did not see it the first time. Property tax contributions from the taxpayers has been monotonically increasing. If unfunded long term liabilities can be considered long term debt, it can be said that Framingham is reaching its borrowing capacity according to MGL 44-10. If the state mandates payment of Other Post Employment Benefits as specified by our Long Term Financial Report

then these do become new long term debts.

All relevant information is on

|

Send comments to:

hjw2001@gmail.com

hjw2001@gmail.com

|

|