|

Every tax is a pay cut. Every tax cut is a pay raise.

Citizens for Limited Taxation |

|

Click here

for the raw data for these graphs.

| |

|---|---|

> >

| |

|

|

| Future values (2008-2012) were based on

Framingham's five year financial forecast

.

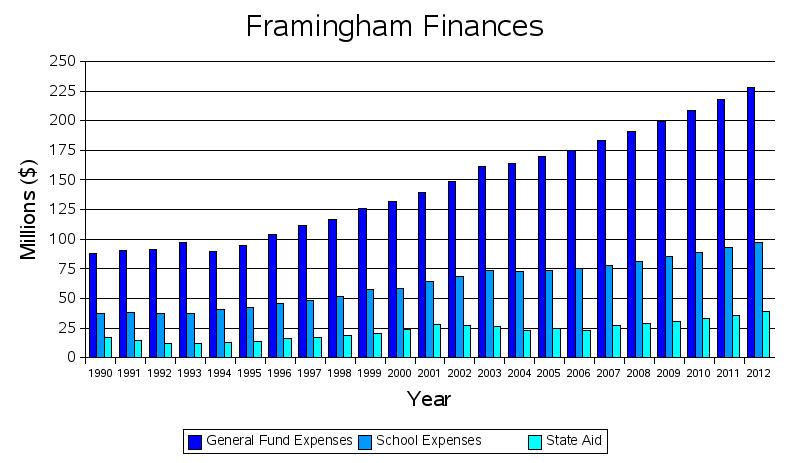

In 1996, in it's 296th year of operation, the Town of Framingham reached a milestone when it's General Fund went over $100 million. Eleven years later, the General Fund stands at $183 million. Using dubious accounting practices, the Town of Framingham continues to deliberately obfuscate the amount of money being spent on schools The sharp drop in 1994 was caused when the Enterprise Fund was split from the General Fund. |

|

|

|

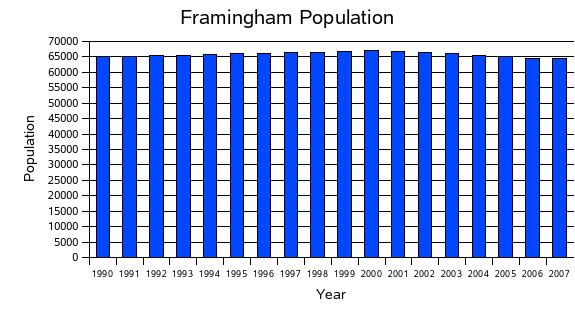

| While the General Fund reaches for the stratosphere, the population of Framingham has actually decreased. That would of course be the legal population . The elephant in Framingham's financial living room is illegal immigration, mostly from Brazil, thanks to their Welcoming Proclamation. The price of this affliction shows up in our school costs and is an open-ended cost to the taxpayers. | |

|

|

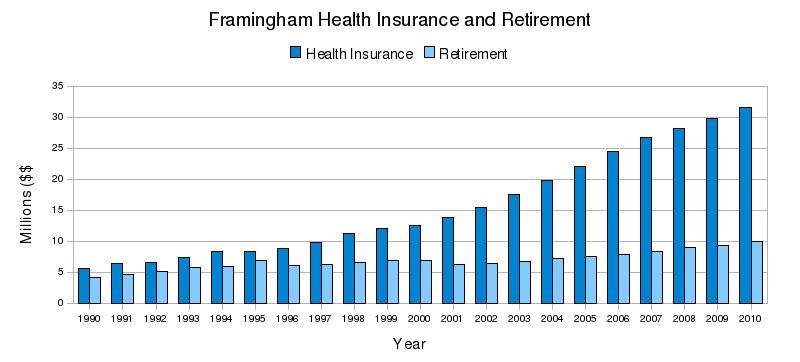

| If you do not see Framingham's other big financial problem in the

graph above, click

here.

If our new town manager, Julian Suso, cannot get the town's

public sector unions

to give in on paying a greater share of this expense,

then his net worth basically diminishes to zero. Health insurance

costs are now fourteen (14%) percent of every tax dollar.

In early 2005, the Town of Framingham had a $71 million funding shortfall in their pension plan. Taxpayer contributions to the pension fund will be increased by four (4%) per year until this shortfall has to be paid in 2028. |

|

|

|

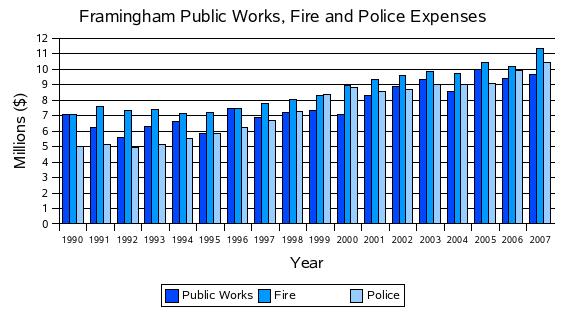

| And it's a neck to neck race between these departments but it looks like the Fire Department is making headway, but the Police Department is coming up from the rear. | |

| |

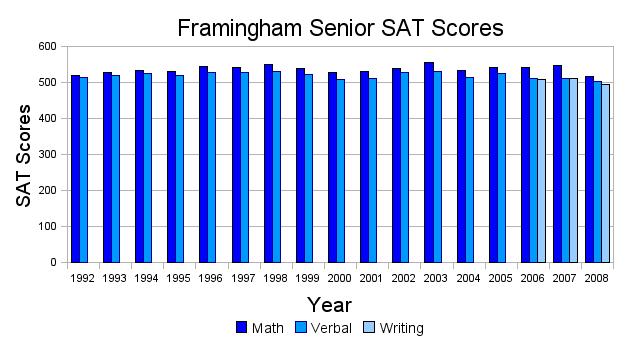

| While our SAT scores are higher than the state average, we are going nowhere fast for our increasing school costs. |

Send comments to:

hjw2001@gmail.com

hjw2001@gmail.com

|

|