|

Medicaid: 70.4 million enrolled in Medicaid, 22% of the population.

Medicaid: 53 million enrolled, receiving $405 billion, $7,800 per person (2012)

Food stamps: 46.7 million enrolled receiving $75 billion, $1,605 per recipient

(2012)

Food stamps: 47.6 million enrolled receiving $80 billion, $1,671 per recipient

(2013)

August, 2012: 8,786,049 American workers are collecting federal disability insurance under Social Security

January, 2013: 8,830,026 American workers are collecting federal disability insurance under Social Security

In August, 2012, In August 2012, 142,101,000 Americans were working

88 million Americans 16 years old or more are not employed in 2012.

56.3 million Americans were on Social Security in 2011.

From 2012 until 2020, approximately 7,000 to 10,000 members of the

war baby generation

will be retiring each and every day and will want their

Social Security and Medicare benefits.

$114 billion constitutes two percent of bank deposits?

The income tax deduction for health insurance/expenses adds up

to $184 billion.

The income tax deduction for home owners interest adds up to

$84 billion.

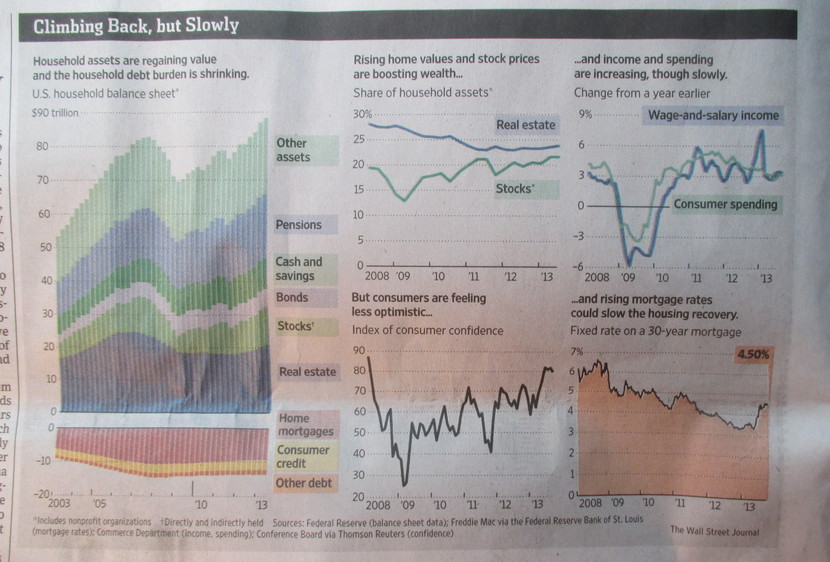

The corporate pension shortfall in June, 2005 was $353.7 billion

In 2012, government paid Lifeline wireless subscribers totaled 269,000

at the annual cost of $1.6 billion.

|

hjw2001@gmail.com

hjw2001@gmail.com